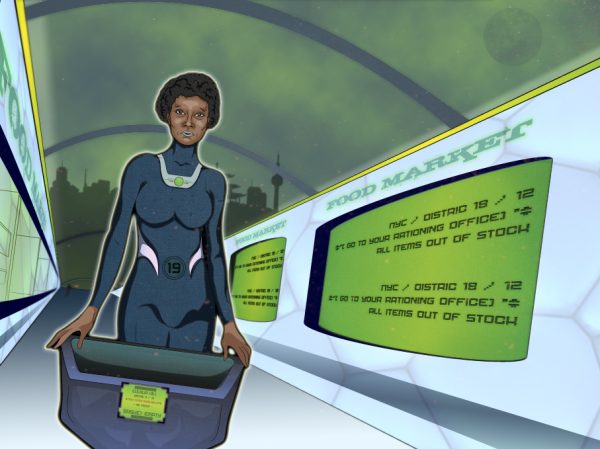

Since summer, I have been working hard to launch my latest startup: Shift Group, taking entrepreneurship training online to the masses, using sustainable business practices we’ve developed. Actually, we’re gamifying it (creating an educational video game:

And while we’ve worked with thousand entrepreneurs worldwide to raise capital and launch, each experience was different.

For some, it took a large amount of the entrepreneur’s time, and many months! But certain things are usually the same in raising money. By implementing these five steps below, you can dramatically improve your results in raising capital while accelerating how quickly you get it.

Three Parts to Achieving Greatness

And I have found the following three key elements to achieving greatness:

Step 1: Determine the Money

Before you get started, you need to be clear on what type of capital you want and from whom you want it, usually based on the stage of your business: idea, pre-revenue, early, launch, growth, high growth or mature.

Normally a new business gets startup capital from Friends, Family and Fools. They are the ones most likely to help, because they know, trust and love the entrepreneur.

For those who don’t have the F, F, or F to help them, a newer way to do this is via crowd funding. Kickstarter and Indigogo are the big better-known sites, but can take a lot of work to set up, follow up, and maintain a campaign.

Loans are also a possibility, yet most large and medium-sized banks are very, very difficult to get a loan from. But when you have a lot of collateral, solid business credit and already have sales and customers, they can be a Godsend.

Post-idea stage usually is when regular and angel / angel investor groups step up. They tend to invest between $50-250K. Angels do much more than invest in the company. They help out.

These seasoned investors rarely invest in something without “knowing the space”. Getting your first angel investor can take time because their #1 reason for investing is because of like. And to get to know you usually takes time.

The next phase of capital usually comes the Venture Capitalists (also known as Vulture Capitalists.) Their sweet spot tends to be $2-5MM, and a few are now going as low as $500K.

The difference between VCs and angels are VCs invest other people’s money, and tend to be much more aggressive in negotiating than angels, which use their own money.

Lastly comes the institutional round of capital. These banks, pension funds, etc. put in large amounts of capital. They usually look at deals starting at $25MM.

Step 2: Declare Your Why

Once you have an idea what type of capital you need, you must articulate a powerful story as to why you and your company.

To do this, I recommend you invest 17 minutes of your time to watch the third most popular TED Talk: Simon Sinek’s How Great Leaders Inspire Action.

This will help you build up your vision, from which everything else that will flow.

Step 3: Build Your Team—

All experienced investors much prefer an A Team with a B Idea over a B Team with an A Idea.

Ideas are a dime a dozen. It’s the team’s expertise that makes them happen. Don’t have that nor the capital to create one? Leverage your Why Statement (see Step 2).

Think this is a bunch of malarkey? Check out Shift Group’s Team and Advisors. ALL of them joined because of our Why Statement. It took almost no money to pay them to join us.

Step 4: Create Your Case

Your case for investors :

- Team

- Purpose ( vision/why )

- Concept

- Stage

- Industry Problem

- Solution

- Market Size

- Competition

- Financials

- Deal

Documents for investors

- 1-pager

- Slide deck

- Financials

Three Exceptions

- Banks and government institutions, which may require a full business plan or an Executive Summary,

- Friends, families and fools may not need to see anything.

- Crowd funders—will need a video, a story, and your list of contacts to market to.

Step 5: Hit the Road

Armed with Steps 1-4, you’re now ready to go and get capital. I’d recommend you create a list of investor leads, and categorize them from A-D, where A’s are ‘home run’ and D’s are ‘not likely’.

Then start with your D List. Make your mistakes and learn from them before you head up to you’re A List.

During Step 5, remember to keep your head and focus on your Why when you meet with potential funders. They are looking for your (authentic) passion.

In Shift Group’s case, we’ve built a great team, landed a few really great, large clients, and joined a really cool accelerator in NYC: EdgeEdTech.

All recipes for success, right?

In many ways, yes. Yet the process, the relationship-building and relentless attention to detail can take vigilance along the way.

But what a great feeling it is when it all comes together like you envision!

Action Steps for the Week

You think you need to raise some outside money?

Start with the numbers. How much do you think you’ll need to get to breakeven and show a profit? How long will that take you?

Then go into your Why Statement, and define the perfect team you’ll need to help you get to the next level. For those holes you have on your team, leverage your Why to bring them on board.

Remember, please reach out if you have any questions!